What you need to know to make the right decisions now

When it comes to health care the cacophony of opinions from experts, real and so-called, can be deafening. In fact, from Obamacare (to repeal and replace or not, what are the straight answers?) to state run health care exchanges to socialized medicine, the conversations can make one’s head spin. But what if you are trying to make decisions that will impact your long term care? Who and what do you believe?

First some facts to help you understand what we are all facing as our generations age. Thirteen percent of people over the age of 60 worldwide require long term care. While that number may seem small it is growing each year. About half of that number suffer from dementia and are unable to make decision about their care. Many have family members who act as healthcare proxies but many more do not. By 2050, the number of people requiring long term care will be about 39%!

So why should you start planning for your long term care, including investing in long term care insurance? The simple answer is to insure your future but here are five other reasons to start

- Cost of Care – It is said that with progress things will become better and easier. However, in terms of health care better and easier means more expensive. The cost of living in a managed care facility today will in all probability quadruple in 25 years, especially with the greying of society.

- Timing – Insurance is great to have when you need it but impossible to buy when you need it. It only make sense. If an insurance company offered to sell homeowners insurance on their homes after disaster strikes the insurance company would have a very brief history.

- Do you trust the government to care for you? Ronald Reagan once said the nine most terrifying words in the English language are ‘I’m from the government and I’m here to help.’ If you think otherwise and you want to know the government’s track record is with providing health care Google ‘VA Hospital scandal’ but be prepared, it’s a long list.

- Paying premiums now makes sense – When it comes to health insurance, starting with a policy when you are young means the premiums you will pay will result in more benefits later in live. For example, start paying premiums for long term care at 55 and a $75,000 investment could result in more than $800,000 in benefits. Wait until you are 75 and $100,000 investment may only result in $310,000 in benefits.

- Tax implications – If you are planning on using other assets to pay for long-term care you should talk to your financial advisor as the tax implications could make the purchase of long term care insurance a more viable option.

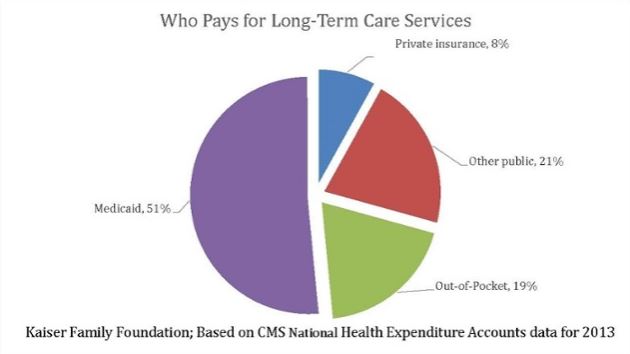

One last thing, if you think that Social Security will take care of all the costs, look at this graph that shows where long-term care funds were coming from in 2013. With all the talk of Social Security running out of money, the graying of America will definitely cost you more than you think.