Who needs horror movies when you are a tax-paying resident of New York

The end of the first year of the Trump Presidency saw the administration follow through on one of its biggest campaign promises, tax reform. Across the nation private tax-payers and business owners alike are celebrating some much needed financial freedom and the ability to save for the future or to invest in the present.

The end of the first year of the Trump Presidency saw the administration follow through on one of its biggest campaign promises, tax reform. Across the nation private tax-payers and business owners alike are celebrating some much needed financial freedom and the ability to save for the future or to invest in the present.

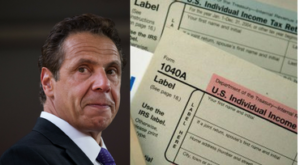

But not everyone is happy with the new tax law as governors of states with the highest state taxes see their states residents’ ability to deduct their state and local taxes (SALT) fully from their federal taxes. Governor’s Cuomo and Brown (New York and California are two of the most adversely affected states) have railed against the administration when really they need to look inwardly at what many would characterize as the confiscatory policies of their respective states. Sadly, in New York, the state and local governments can find a way to tax their citizens for everything.

According to an October 2017 Top 10 list at ThinkAdvisor.com, New York is 3rd behind only Minnesota and Maryland as the least tax friendly states in the union. The rest of the Northeast is no better with New Jersey, Connecticut, Vermont and Maine also in the top 10. So what makes New York among the word besides having the 8th highest state income tax? Here are just a few tidbits:

- Gasoline – $.43 per gallon tax

- Cigarettes – $4.35 per pack tax (buy your cigarettes in New York City and pay another $1.50 in tax)

- Cigars and other tobacco products – taxed at 75% of the wholesale price

- Wireless Internet Service – 17.9% tax

- Prepared Food – buy a bagel and ask for it to be sliced and you pay sales tax

For investors and people with estates they plan to leave to heirs have even more to worry about. While there is not state inheritance tax (yet) there is an estate tax or ‘cliff tax.’ If your estate is valued at 105% of the current New York State exemption the exemption does not apply and the entire is subject to the estate tax.

To add more insult to injury, Governor Cuomo is looking into a possible law suit along with other governors claiming that the reduction in SALT exemption is unconstitutional. However many tax attorneys have stated that there is nothing unconstitutional about what the federal government did and that Governor Cuomo’s arguments are based more in politics disagreement than constitutionality of the new tax law.

For high-wealth individuals who are residents of New York State there are a few options. The first, and the one that would require a lot of drastic change, would be to flee the New York for a state with a more reasonable state tax burden. The more reasonable option would be to seek out a full service financial adviser and experienced accountant who has reviewed the new tax laws and sought out the nuances in state and federal tax laws that will allow for the growth of personal wealth and estate planning that allows for the investor to remain in New York State.